The Short Swing

A short swing is used to make money when a stock’s price is predicted to go down. We sell short the stock. For those unfamiliar with shorting stocks, we sell the stock without having previously owned it. Additional detail about shorting stocks can be found the Appendix. For now, it is only necessary to know that our goal is to sell the stock and buy it back at a lower price.

While anyone can sell short, you must make sure that your brokerage account is approved for trading on margin. If you do not have a margin account, simply fill out the necessary forms with your current brokerage firm or open an account with one of the firms recommended for swing trading.

A short swing is a mirror image of a long swing. The price of a stock in a downtrend tends to have periodic, short-term rallies (pull-ups) as the price moves lower. The set up for a short swing is the brief rally (or pull-up). The decision rules in the Master Plan help enter the trade when the stock is resuming it’s downward path.

A chart showing a downtrend that is conducive to short swing trading is shown on the next page.

Notice in the chart below that the downtrend is interrupted by short-term rallies (pull-ups). The trade is placed after a short-term rally (or pull-up), once the stock resumes its downtrend. The trade is entered on a day when the price falls below the low of the previous day.

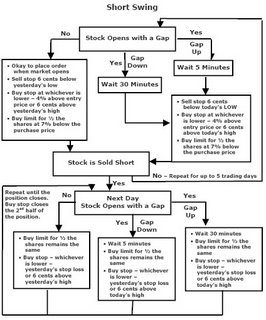

The rules for entering and exiting a short swing are shown schematically on the next page. Notice in the chart below that the downtrend is interrupted by short-term rallies (pull-ups). The trade is placed after a short-term rally (or pull-up), once the stock resumes its downtrend. The trade is entered on a day when the price falls below the low of the previous day.

The rules for entering and exiting a short swing are shown schematically on the next page. Notice in the chart below that the downtrend is interrupted by short-term rallies (pull-ups). The trade is placed after a short-term rally (or pull-up), once the stock resumes its downtrend. The trade is entered on a day when the price falls below the low of the previous day.

While the rules might seem somewhat complicated, several brokerage firms make the process quite easy. Interactive Brokers – described in the next section – allows you to enter the three components of the trade all at the same time. For a short swing they are:

- A sell stop to sell the stock when the price moves below the stop price.

- A buy stop to buy back the shares if the price moves up 4%

- A buy limit to lock in profits (on ½ the shares) when the price drops 7%

The schematic diagram provides instructions for how to adjust these prices on the second day, third day, and so on, based on whether the stock has been sold short or not. The schematic provides exit instructions as well.